How We Regulate

Forex Markets Authority

Our Approach

Intelligence-led and harm-based

We take a risk-based approach to our monitoring and surveillance activities, meaning we prioritise resources to those participants or practices that present the greatest risk to fair, efficient and transparent financial markets.

Outcome-focused

We focus our resources where we have the greatest opportunity of achieving desired outcomes.

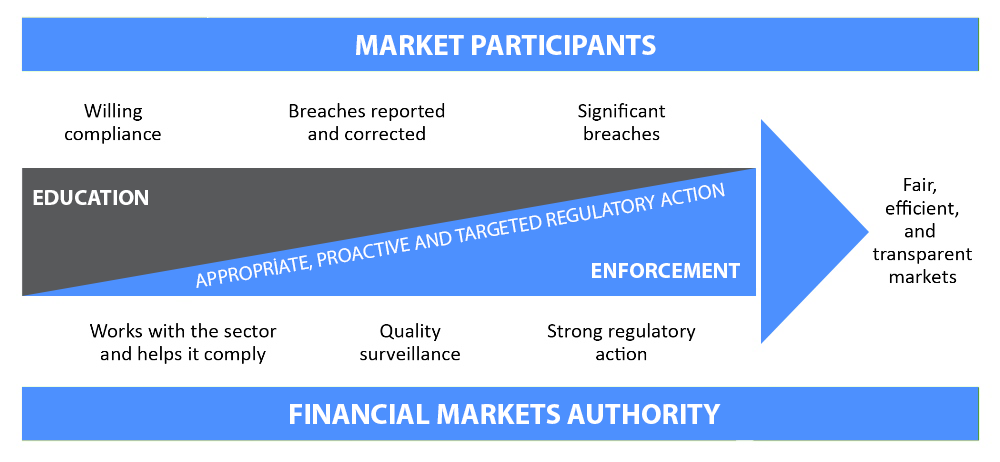

Appropriate, proactive and targeted regulatory action

We have a range of tools available to deliver a timely, effective and proportionate response to identified non-compliance.

Our approach to compliance can be visualised below:

Our regulatory functions

Our regulatory functions support our strategic priorities.

Monitoring and supervision

To help build investor confidence, we assess and monitor compliance, conduct and competency of market participants.

Investigations and enforcement

Our intention is to raise investor confidence by taking timely and proportionate enforcement action and by seeking compensation for investors where appropriate.

Policy and guidance

We provide information and guidance that assists firms and professionals to comply with the law.

Licensing

We licence a range of firms and professionals that meet the requirements of the law.

Education and information

We partner with public and private organisations to develop and promote educational resources and messages to help investors make better investment decisions.